Financial systems, financial governance and economic development

Abstract

The idea that seems to be spreading in response to this crisis to promote the substitution of development financing via private sector institutions in place of government development banks means restoring the inequitable sharing of risk of development finance, promoting instability and protecting finance at the expense of labour, and the inevitable worsening of the distribution of income. Private sector financial markets do not have a good record of providing finance to development investments at levels and rates that would ensure expanding employment, and there is no reason to believe that this will change if the role of development banks is minimized. As liquidity preference becomes the dominant decision variable for investment, Brazil will be back to the problems that Keynes originally analysed in the General Theory, with the addition of the prudential requirements that will aggravate the instability of the growth process, even in the presence of a fully developed domestic financial system, and tilt social support in favour of finance at the expense of labour.Downloads

Download data is not yet available.

Published

2018-01-31

How to Cite

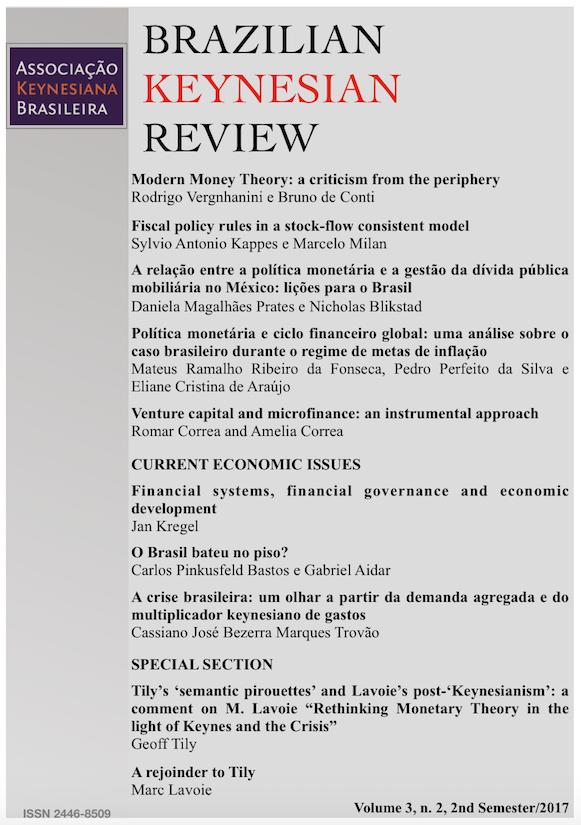

Kregel, J. (2018). Financial systems, financial governance and economic development. Brazilian Keynesian Review, 3(2), 124-129. https://doi.org/10.33834/bkr.v3i2.126

Issue

Section

Current Economic Issues

Copyright (c) 2018 Jan Kregel

This work is licensed under a Creative Commons Attribution 4.0 International License.

- Authors keep copyrights and concede to the Journal the right to the first publication, with the paper simultaneously licenced under the Creative Commons Attribution 4.0 International License which allows recognised author and journal work sharing.

- Authors are authorized to assume additional contracts separately, for non-exclusive versions of the paper published in this journal (e.g.: publish in an instituional repository or as a book chapter) with the recogntion of authorship and initial publication in this journal.

- Authors are allowed (and are estimulated) to publish and distribute their work online (e.g.: in institutional repositories or at their personal websites) at any point before or during the editorial process, once this may generate productive alterations on the paper, as well as increse the factor of impact and quotation of the published paper (please, see Free Access Effect)